choose the best scenario for refinancing answer

Take care to have all of your paperwork in place beforehand so that youre not wasting precious time that your lender could have used to approve you. Ad FInd the Best Refinance Option Just for You Start to Refinance Your Existing Home Loan.

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

You cant refinance your mortgage for less than what you owe because the funds will not be enough to pay off the loan.

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

. Ad We Close Most Refinance Loans In About A Month. National average closing costs for a. An ideal scenario for conventional refinancing is a FICO score above 700 and an LTV below 60 percent.

Best Mortgage Refinance Lenders Compared Reviewed. The lower interest rate drops your monthly payment from 1013 to 898 a. The best scenario for refinancing.

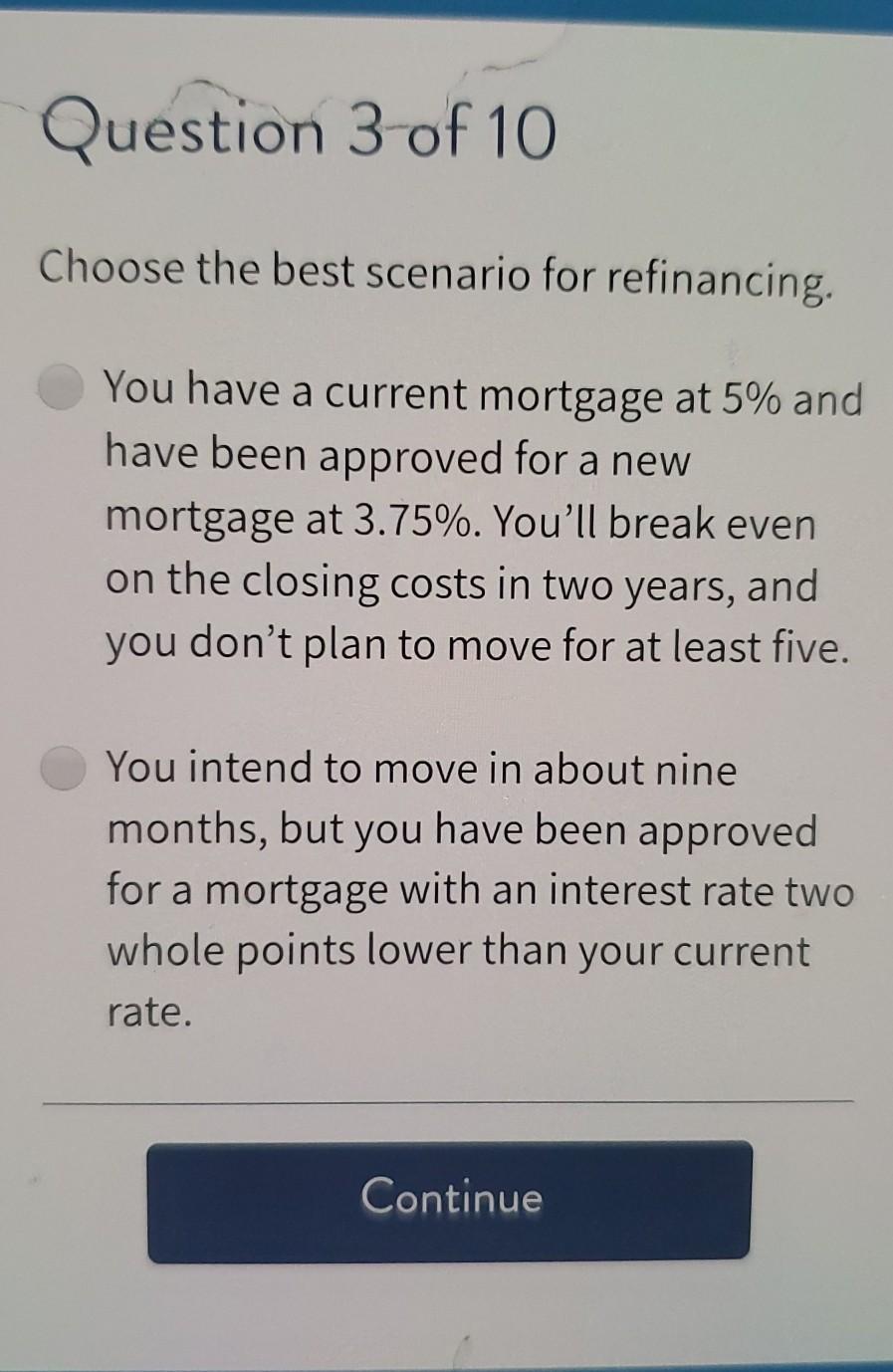

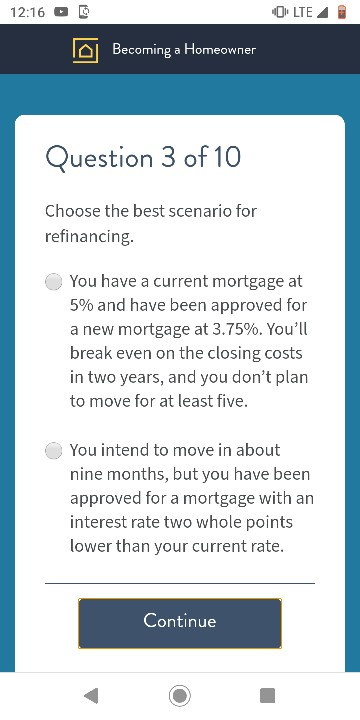

Planning to stay in the home for at least seven years 2. You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing.

Ad Read Expert Reviews Compare The Best Companies For Your Mortgage Refinance. Finance questions and answers. The lower interest rate.

Here are five questions to ask yourself before you refinance your current mortgage. What rate makes sense for you. Our Trusted Reviews Help You Make A More Informed Refi Decision.

A drastic change in finances. Never accept an adjustable-rate mortgage. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

2-Which one of these is the best. For example you can refinance a 15-year mortgage to a 30-year term. 3-Choose the best scenario for.

Take the example from no. Automatically rolling fees into the new loan. Compare Get Exclusive Offers and Rates from Top Lenders in US.

3 Scenarios Where Refinancing is the Best Option 1. 1-One of the most important features of a filing and record keeping system is that it works for you and meets your needs. While theres no standard way to calculate you can generally plan on paying about 2 to 5 of your refinance amount in closing costs.

Optimize your credit score. Refinancing from 45 percent to 35 percent on a 200000 loan. See offers from verified BBB accredited partners.

Use a budget to live within your means and build savings. Get Started Refinance Today. Ad Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You.

The best scenario for refinancing. Get Started Refinance Today. Mortgage interest rates have been low for a while.

Ad We Close Most Refinance Loans In About A Month. Question 3 of 10 Choose the best scenario for refinancing. This strategy can be.

Save 50 or more monthly. You pay off the first loan allowing the second loan to be created instead of simply making a new mortgage and throwing out the original one. How does refinancing work.

Answer below. Lower the mortgage term. Save at least 1 of your homes purchase price annually ANSWER- Refinance as soon as possible Use a budget to live within your means and build savings Never accept an adjustable.

Dont Wait For A Stimulus From Congress Refi Before Rates Rise. Competitive Rates Fast Approval. ANSWER-Refinance as soon as possible.

When this happens the lender who holds your first. Your credit history is one of the most important criteria lenders look at when you start the mortgage refinancing process. Youll break even on the.

You want to lower your interest rate. Fixed-rate mortgage balloon note construction loan an. You have a current mortgage at 5 and have been approved for a new mortgage.

Ad Compare 2022s Mortgage Refinance Reviews. You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing.

Put Your Equity To Work. The best scenario for refinancing is. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

When you refinance your rate or term your monthly payment changes without changing your principal. Ad Compare and Get Approved For The Best Refinance Mortgage Option that Suits You. Save at least 1 of your homes purchase price annually ANSWER-Refinance as soon as possible Use a budget to live within your means and build savings Never accept an adjustable.

Choose the best scenario for refinancing answer Sunday March 13 2022 We have a number of business loan options like term loans invoice factoring merchant cash. The best scenario for refinancing. When you have little to no equity 3.

Rates change constantly and a spike could ruin the savings that make a refinance worth doing. Borrowers can qualify for refinancing with LTVs of 80 percent or lower. Compared Online Companies Best Terms Fast Approval Apply Now For Free Offer.

Ad Weve rated the best options for getting out of debt. Youll pay interest on the sum. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Types of loans to calculate include.

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

The Best Scenario For Refinancing At Best

Choose The Best Scenario For Refinancing

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

The Best Scenario For Refinancing At Best

The Best Scenario For Refinancing At Best

Should You Break Your Mortgage Moneysense

The Best Scenario For Refinancing At Best

When Is Refinancing Worth It Ally

Is Refinancing A Bad Idea Assurance Financial

Solved Should I Refinance My Mortgage Bob Vila

9 Answers To Your Burning Mortgage Questions Forbes Advisor

What Happens To My Mortgage If I Move Assurance Financial

Pin By Chadstone Kia On Articles From Chadstone Kia Refinance Car Car Loans Car Finance

Climate Change Thread Tl Dr We Are So Screwed The Something Awful Forums Climate Change Dr We Change

:max_bytes(150000):strip_icc()/shutterstock_543954217-5bfc477d46e0fb0051823e47.jpg)

Should You Refinance Your Mortgage When Interest Rates Rise

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)